The recent announcement by Act-Geo about potential oil and gas reserves in the East Sea has captured significant public and governmental attention. The South Korean government swiftly approved an expensive exploration project based on Act-Geo’s optimistic analysis. However, this development has not been without controversy, raising questions about the project’s viability, the credibility of Act-Geo, and the wisdom of such a large financial commitment in the face of global energy shifts.

In a striking contrast to Act-Geo’s findings, Australia’s Woodside Energy, after conducting deep-sea exploration near the Ulleung Basin in the East Sea for 15 years, abandoned the project in January 2023. Woodside’s 2023 annual report indicated that areas including South Korea, Canada, Peru, and Myanmar were “no longer considered prospective” and thus were exited due to lack of future value. This raises significant concerns about the feasibility of Act-Geo’s recent positive assessments.

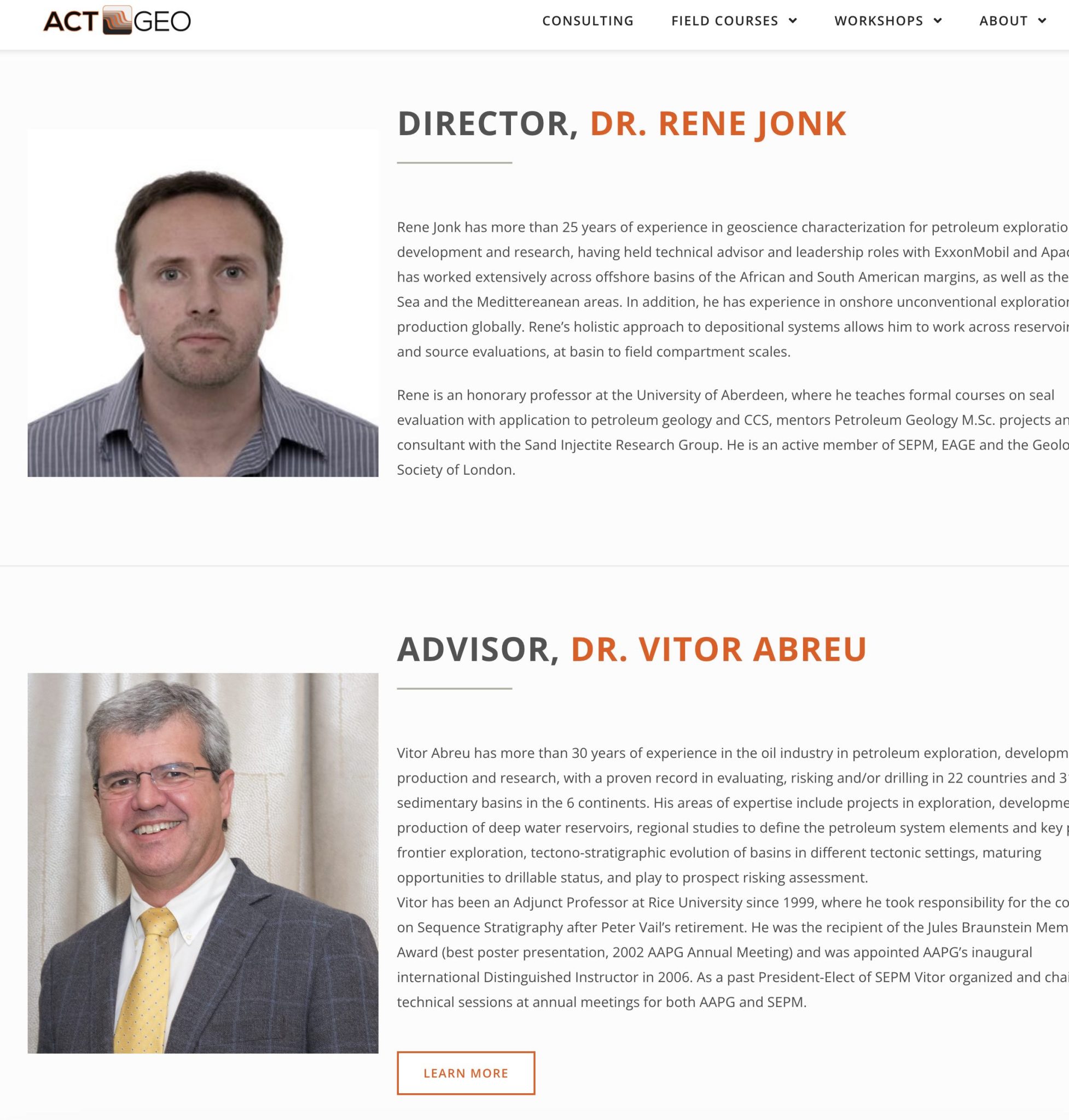

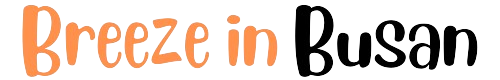

The credibility of Act-Geo itself has been questioned following revelations about its corporate status. In 2019, the company had its corporate license revoked due to unpaid taxes and only reinstated it after settling its debts in March 2023. Despite these issues, KNOC defended its partnership with Act-Geo, stating that the company’s capacity to enter contracts was not wholly impaired by its temporary license revocation. However, this explanation has done little to allay public skepticism about the transparency and propriety of the contracting process.

Adding to the controversy is the revelation that Act-Geo’s registered address is a residential property. This has led to further doubts about the company’s legitimacy and operational capacity. Act-Geo’s representatives have explained that the company operates a decentralized model with consultants based around the world, which they argue does not diminish their analytical capabilities.

Act-Geo’s analysis highlighted favorable geological conditions in the East Sea, such as the presence of cap rocks and reservoir rocks, essential for hydrocarbon accumulation. The firm estimated a 20% success rate for discovering commercially viable quantities of oil and gas. This success rate, while seemingly promising, also implies an 80% risk of failure, a significant consideration given the high costs involved.

To provide a broader perspective, it’s essential to note that similar success rates in other regions have led to significant discoveries. For instance, the Liza field in Guyana had a 16% success rate and has become one of the largest oil finds of recent years. However, such outcomes are exceptional, and the inherent risks remain high.

High Costs and Low Success: Is It Worth It?

The financial implications of the exploration project are substantial. Each exploratory well is expected to cost around 100 billion KRW, and multiple wells will be required to adequately assess the area. With a success rate of only 20%, the total investment could easily reach 500 billion KRW. Such a high-cost, high-risk venture necessitates a critical evaluation of its potential returns versus its significant financial and environmental costs.

Investing such a substantial amount into a project with an 80% failure rate raises questions about the strategic allocation of resources. The opportunity cost is high, and many argue that these funds could be better spent on advancing renewable energy projects, which align more closely with global trends toward sustainable energy and carbon reduction.

The Case for Renewable Energy

At a time when the global focus is shifting toward decarbonization and sustainable energy, the wisdom of investing heavily in oil exploration is increasingly questioned. Even if substantial oil reserves are discovered, the costs of extraction, transportation, and usage must be considered. The current trend toward renewable energy sources suggests that funds might be better allocated toward supporting green energy initiatives, which offer more sustainable long-term benefits.

Given the substantial investments required for the exploration and the long-term environmental impact of fossil fuel extraction, the government’s decision is at odds with global energy trends. Investing in renewable energy companies and providing subsidies for green energy initiatives could yield more significant benefits for both the economy and the environment.

The East Sea oil exploration project is fraught with uncertainties, from the credibility of the initial analysis to the high financial and environmental costs involved. The stark contrast between Act-Geo’s optimistic projections and Woodside’s decision to withdraw raises serious questions about the project’s viability. Given the global shift towards sustainable energy, it may be more prudent to invest in renewable energy projects rather than in high-risk oil exploration. Transparent and thorough scrutiny is essential before committing further resources to this contentious project.