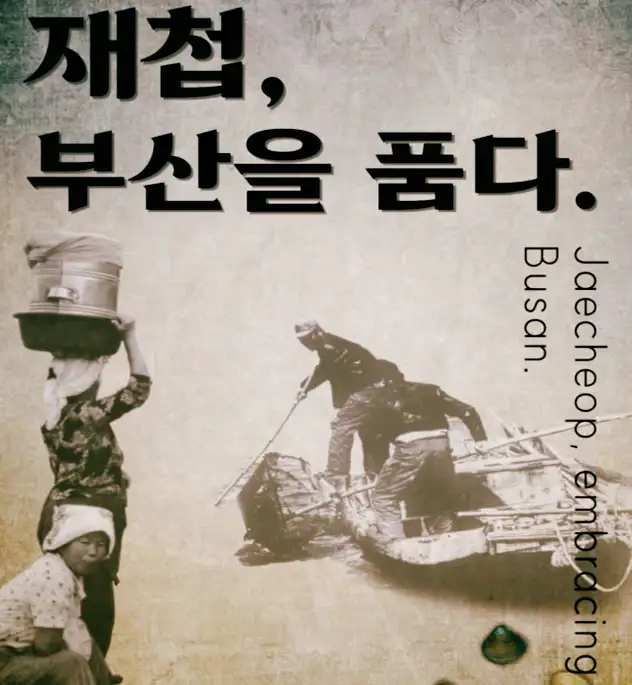

The Korean Peninsula Faces Heat, Crop Stress, and Import Risks in 2025

Global forecasts show 2025 will be one of the hottest summers on record. As glaciers melt and harvests shrink, the link between climate change and food insecurity becomes alarmingly real.